Twelve months on from their first report, Citizens Advice (CA) have issued a new report on discriminatory pricing in the UK motor insurance market. This new research reaffirms their original findings, that people of colour, and black people in particular, are paying more for their motor insurance.

There’s four key messages coming out of the CA report:

- This is an issue they will continue to push on, in line with their remark last year that insurance is seen as a test case for a wider problem with discriminatory pricing in digital decision systems;

- They’re being open with how they’ve arrived at their findings, providing information on the relevant survey population and how key measures were derived. This is a calculated openness, designed as a contrast to what has emerged from the sector so far;

- They’ve opened up the scope of their challenge, highlighting key themes like cancellations. Further key themes are likely to merge over the next twelve months;

- The ethnicity penalty is now being aligned with the poverty premium. This both highlights how the two are linked, as well as increases pressure on the sector.

Let’s explore each of these points in turn.

Not Going Away

As I predicted, CA have continued to research discriminatory pricing. They now have two studies that point to problems in the sector’s pricing. And out of this has emerged two clear numbers: on average, people of colour pay 40% more than white people, and black people pay 49% more than white people. These numbers are well outside statistical significances, as the CA report point out.

So why are they spending money on further research? It’s because that research evidences the case they’re bringing against insurers. It also underpins the pressure they’re exerting on the FCA. This is because while CA are prepared to go along with the FCA’s plan for discriminatory pricing being dealt with through the consumer duty, they not nailing all their colours to that single mast.

Indeed, the CA has this to say about the consumer duty:

“Tackling the ethnicity penalty is an essential test of whether the Consumer Duty works – without the FCA making this clear to firms and treating this as a priority, the Consumer Duty is likely to fail this test.”

This tells insurers that unless they’re feeding pricing data to the FCA and unless the FCA comes out with their own analysis around discriminatory pricing, the CA will do more research next year. So either which way, transparency of pricing outcomes will be the trend of the next few years. Insurers need to prepare for this, pretty immediately (as I said here) for internal audiences, and over the next few months for external audiences like the FCA or the Equalities and Human Rights Commission (EHRC).

An Untested Solution

Consider this comment from the CA report:

“…Citizens Advice is calling for the FCA to treat this problem as an urgent priority and make sure insurers do the same. We’ve collected this data for a second year running, but the FCA needs to start monitoring insurance pricing across ethnicity itself and prioritise holding the firms that aren’t taking action against this difference in pricing to account."

This tells us two things. Firstly, CA think that there may perhaps be pockets of good practice in the sector. They talk about firms, not the sector. And secondly, the FCA’s monitoring work is either too simple or ill focussed. We know that as a result of the loyal penalty and the ban on pricing walking, that the FCA were obtaining pricing data from insurers. What CA are saying is that they’re not doing enough with that data.

Why is the CA so pointed on this? Because they think that discriminatory pricing is not high enough up the FCA’s priority list. Indeed, the tone of how CA puts this indicates they think it’s not a case of ‘high enough’ priority, but a case of it being a priority at all.

Are they right on that last point? I think they are. If you look at the FCA’s business plan for 2023-24, there’s no mention of discriminatory pricing. What the FCA have as a key priority is the consumer duty, and the duty is being pitched as the means of solving a whole range of problems like discriminatory pricing. That’s a risky strategy because it’s an untested means by which to deliver meaningful change across the issues raised by digital decision systems.

Target Audience

When a consumer group publishes the methodology for how they arrived at a research finding, it does so not with (as in this case) insurers or the regulator in mind, but with the political establishment in mind. The message to politicians is that “we’ve done our homework and we’ve been open about how we’ve done it”. In essence, “we’re more believable than those other guys, so take the steps we’re saying this situation deserves.”

Unless I’ve missed something, the sector’s response is that they don’t collect data on ethnicity or use it as a risk factor when making pricing decisions. That might be the case. Nevertheless, it is at best an inadequate response, for the simple reason (as every insurer should know, and CA points out) that accidental or indirect discrimination is still discrimination under the law.

Given the impact that the loyalty penalty had on personal lines pricing, it would be a natural expectation on the part of the public and investors that insurers (and in particular, their boards and committees) would have taken steps to make sure something similar doesn’t happen again. Discriminatory pricing is an obvious ‘something similar’ – at least since the first CA report in March 2022 and at most some nine years back, when it first came onto my radar.

What CA are saying is: ‘what have insurers been doing internally to investigate this?’ If on the face of it, the answer to that seems to be at best ‘not enough’, then isn’t this then an issue for the Senior Managers and Certification Regime (SMCR), the FCA initiative to improve accountability across regulated firms. If it is, then have the FCA put ‘too many initiative eggs into one basket’?

In a coincidence of timing, the three financial regulators launched a review of how effective the SMCR has been, on the same day that the CA issued their second ethnicity penalty report. Part of me thinks that the SMCR should have helped senior management function holders to see the issue, ask the right questions, seek confirming data and draw their conclusions, in relation to discriminatory pricing. Has this happened? I’m not convinced it has. Like the consumer duty, SMCR launched a welter of very profitable projects for big consultancy firms. Have the right compliance boxes been ticked as a result. Yes, of course. Have outcomes been improved as a result? This review may cast new light on that.

Some insurers may well have carried out internal reviews, and be wary of being open about having done so. Who wants to put their ‘heads above the parapet first’, goes the argument put to me on several occasions recently. The ’competitive advantage’ problem rears its head again. The problem is that the loyalty penalty showed how useless the parapet can sometimes turn out as a defence.

Broadening Scope

Early on in the CA report, a prominent mention is made of policies being cancelled. And by cancelled, we mean finished mid-term, not just not renewed. Here’s a key quote…

“With costs rising across the board people are being forced to make difficult decisions about their spending. Using findings from nationally representative polling we estimate that over one million people cancelled their car insurance in the last year amidst pressure from rising bills. Worryingly, people of colour were three times more likely to cancel their car insurance than white people.”

“A further 42% of people of colour reported that they anticipate needing to cut back on their car insurance in the next 6 months, compared to 24% of the general population and 21% of white people.”

Expense Optimisation

So what, you might ask? Isn’t it good that policies can be cancelled in this way. Well, that might be the case if many insurers in the sector saw it the same way. A key private database used by around 90% of the UK motor insurance market draws cancellation information from contributing insurers and feeds that back as an expense factor for all to use in pricing decisions. This is what I would call expense optimisation (more on this in a future article).

This means that those people who can no longer afford their motor insurance and are cancelling it as a result, will face higher premiums next time they seek cover, all other factors being equal. With people of colour three times more likely to cancel their motor insurance than white people, this approach to pricing clearly has wider public policy implications.

Hidden Cards

So, as an insurer, you should be asking: should I expense optimise? If I do, do I know enough about the risks associated with that? Am I monitoring and controlling those risks? Remember that the software house providing that private database may not be the best source of that risk assessment.

With the CA highlighting cancellation rates, what might they choose to highlight next? The obvious one is credit scores, about which consumers groups have long raised questions (more here). Credit scores are however a sizable, multi-faceted target to address. Might CA have perhaps been doing work on this in preparation? It’s possible.

Two thoughts come to mind. The first is that bringing in credit scores may cause their campaign to lose focus. The second is that if they’ve done their research (as they seem to do every time), then they may have a strong enough case to warrant making a confident challenge on credit scores.

The Poverty Premium

Another feature of this second ethnicity penalty report is the alignment it evidences with the poverty premium (more here).

“The average price of insurance for our clients was significantly higher than the average price reported by the Association of British Insurers. Given that the average income of our clients is just under £18,000, this difference can likely be attributed to the poverty premium. Furthermore, our results show that our clients of colour are being penalised on top of that by a significant ethnicity penalty which is independent to income.”

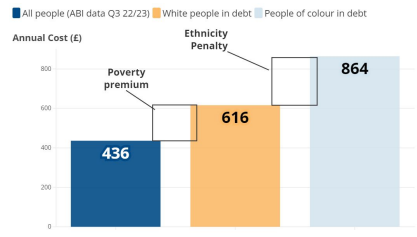

The message being conveyed is that because people of colour generally have lower incomes, the impact of the poverty premium and the ethnicity penalty are cumulative. The latter sits on top of the former, as illustrated by this graph in the CA report…

What we have then are two research reports taking aim at the sector in ways that stir political interest. Both have produced data that is now defining the debate. In short, I believe the sector has lost control of the narrative, unable to set out a counter argument other than ‘we don’t do that’.

Will lobbying by the Association of British Insurers be able to move this narrative more in insurers’ favour? Their new chair is a former cabinet minister and former chair of the Treasury Committee, so a big hitter in political terms. Even then, I still think the ABI will struggle, given how little control they seem to be exerting over the narrative. And should a poor narrative lose them that debate, where will its insurer members then stand?

Summing Up

If you stand back from the detail of this second report, what I think it indicates is that the initiative is still firmly with Citizens Advice. The FCA are betting on an untested consumer duty that will take too long to deliver. They seem almost to be standing back from the problem and signalling to the sector that discriminatory pricing is something the market has to make go away.

Meanwhile the ABI seems to be relying on their traditional lobbying strengths to defuse the situation. I’m not convinced they’ll succeed. After all, it didn’t work with the loyalty penalty.

In around two years’ time, we will see some form of league table of discriminatory pricing. The insurers toward the top will become more trusted. The ones towards the bottom are in danger of being demoted out of the personal lines market, until they can prove that the issue has been fully dealt with. That will be very painful for them.

So individual insurers need to ask three questions: firstly, ‘can we rely on the ABI to make this problem go away, given they didn’t manage to last time?’ Secondly, ‘is the consumer duty going to achieve enough, and soon enough?’ And finally, ‘on current activity, where might we end up on that league table?’