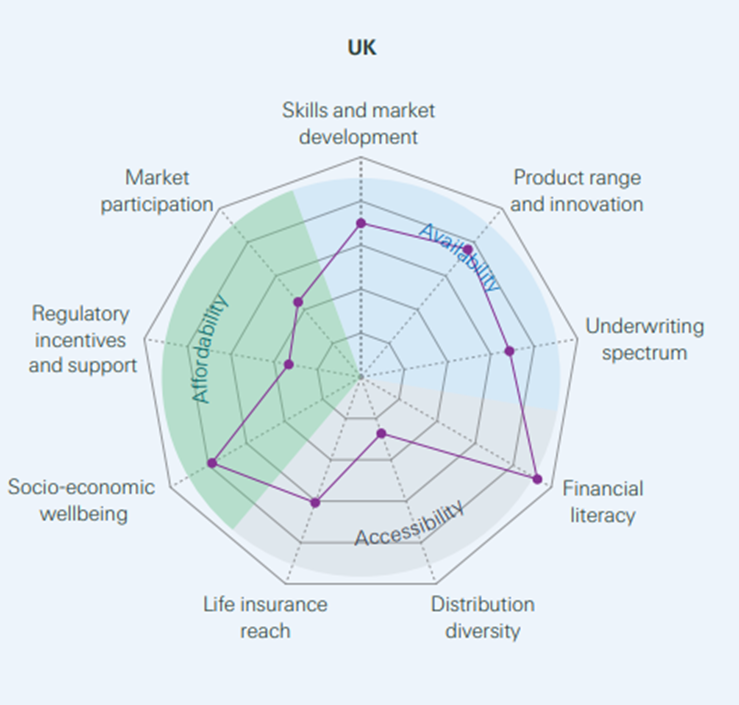

Swiss Re published their ‘Life and Health Insurance Inclusion Radar’ report recently, exploring what makes different countries’ markets more or less inclusive. They chose three dimensions of inclusivity - availability, accessibility and affordability – and supported each with specific sets of metrics.

I have concerns about some of the underlying data, which I will set out later, but for now, the big questions I have relate to the UK’s performance on this radar.

On availability, it performed very well, sitting in top position alongside the US market. By availability, Swiss Re means “the existence of protection products/plans that adequately meet the range of mortality and morbidity protection needs of society.”

On accessibility the UK performed relatively poorly for an advanced market. By accessibility, Swiss Re means “the places, people and processes deployed to connect available insurance products with the potential buyers.”

On affordability, the UK performed badly, coming last amongst advanced markets by a good measure. It was interesting how many emerging markets did much better. By affordability, Swiss Re means “whether insurance product premium price-points are reasonable within the financial resources of intended buyers and convey fair value.”

I’m going to drill down now into what the UK’s performance tells us about the L&H market here. And I’m going to take a close look at the recommended next steps that Swiss Re proposes. They’re a somewhat hit and miss mix.

The Affordability Puzzle

The obvious puzzle in relation to the UK L&H market is that it scores very high on availability but low on affordability. This tells that the products are there but consumers aren’t, or can’t, or won’t buy them.

Of the three components to affordability, the UK scored well on socio-economic wellbeing but poorly on regulatory incentives / support and market participation (see radar chart below). It was also particularly poor on distribution diversity, which points to distribution being dominated by white, middle aged men.

What this tells us is that we have the expertise, products and market structure, but they’re not being used to increase take-up amongst low income consumers. Is this a consequence of the switch from commission to fee based advice after the FSA’s Retail Distribution Review? Or it is down to the market just preferring to compete for middle to high income consumers rather than seek out low incomes consumers? Is the low score on regulatory incentives / support telling us something about the hurdles faced by the market, or there being just too little innovation irrespective of the hurdles?

It’s a Trust Thing

The other aspect of affordability that stood out for me was about something the Swiss Re writers seem to steer clear of, which is trust. Is it that low income consumers don’t buy from the L&H market because they don’t trust the market? Is this the product not delivering on its promises, or being too complex, or the way in which they are sold?

Trust in the long term market has certainly had its ups and downs. It could well be a hangover from the payment protection insurance scandal but perhaps even the earlier pensions scandal as well. Whatever the reason, it’s clearly a barrier and the market needs to grasp it in order to address it.

It’s Not Always Been This Way

The UK market has not always suffered from these problems. One just has to look back to the emergence and growth of the industrial life market to see how innovation, strategy and distribution can massively increase take up of long term products amongst low income consumers. In fact, the UK was so good at this that the model was widely adopted in other countries.

So just as the market hasn’t always been like this, the future needn’t be either.

Always Look at Sources

It’s always worthwhile with studies like this to dig down into the way in which the data that underpins them has been derived. This quote gives us an overview...

“For each of the three dimensions (availability, accessibility and affordability), we have selected several sub-indicators that we seek to quantify using primary and secondary-sourced data, and analysed these for a sample of 16 countries (five advanced and 11 emerging markets)”

...but this quote then raises questions...

“Due to a lack of secondary-source data, the primary-source data for the sub-indicators of Availability are the responses given by 35 Swiss Re experts from the 16 sample markets to a set of interview questions covering various aspects of the three dimensions. The secondary data used, such as statistics on bank account holdings and mobile phone penetration rates, are predominantly from the World Bank’s World Development Indicators.”

As the first such report, I can go along an approach that is essentially ‘we talked to our local people and got their opinions’, but not for long. If as I imagine they will do, Swiss Re repeats the survey in a few year’s time, then more robust primary and secondary data needs to be brought in.

Looking Ahead

The report does indeed look ahead...

“We see four main areas for positive action. First, insurers should undertake consumer based market research that prioritises underserved communities. Second they should engage in strategic partnerships to foster diversity in distribution and use digital technology to achieve scale. Third, they should continue to innovate in product design alongside more efficient, inclusive underwriting practices and fourth, foster dialogue with regulators to strike the right balance between innovation and consumer protection”

Let’s look at each of these steps in turn. There’s a lot of sense in undertaking consumer based research in relation to underserved communities, but only if the research is structured around what those underserved communities think is important, and not just what reinsurers think is important. This really does matter and the best way of delivering on it is an early engagement with consumer groups experienced in the needs of underserved communities.

What Swiss Re are talking about in terms of distribution partnerships is some form of embedded insurance. Now, to be brutely honest, payment protection insurance was an analogue form of embedded product and it was a huge disaster. So such partnerships are fine, and potentially valuable, so long as issues around informed consent, value, fairness and conflicts of interest are dealt with at the outset. If not, then embedded L&H products will just go the same way as PPI.

In calling for continued innovation in product design and underwriting practices, insurers need first to understand why the innovation and underwriting that has so far been happening has ended up delivering such poor scores in affordability for UK consumers. I suspect this is not so much about the innovation not being good enough, but the strategic drive and leadership support to do so being lacking.

As a result, there hasn’t been the right culture to address access and affordability. If the market wants to ‘continue’ to innovate, then it needs to make sure that they’re building upon the right cultural base. If not, underserved communities will be end up being just as much, if not more, underserved. So this is not a ‘we have not been innovating enough’ thing, but a ‘why are we innovating the way we are’ thing.

And finally, in terms of fostering dialogue with regulators, there’s little to add other than to make sure that there is just as much if not more dialogue with consumer groups experienced in underserved communities. It’s a three way thing.

To Sum Up

This is a good study that sheds light on some interesting market characteristics. It does however need to do three things. Firstly, improve its primary data. Secondly, be braver in exploring issues like trust. And thirdly, engage with consumer groups to understand more of particular issues raised in this report.

It is important with studies like this that those undertaking them have as their primary purpose the socio-economic importance of reducing protection gaps. That’s why it’s referred to as inclusion rather than expansion. The danger is that market studies like this can sometimes read too much like ‘expansion of market’. It’s a subtle difference that corporates need to take care with. It’s what in terms of trustworthiness is called goodwill. In my opinion, there’s a reasonable amount of goodwill in this report, but the next report needs to build upon it. I await it with interest.